CoinDesk Owner Bullish $4.2B IPO Backed by BlackRock and ARK

CoinDesk Owner Bullish Targets $4.2B IPO Backed by BlackRock and ARK

CoinDesk owner Bullish is aiming for a valuation of up to $4.2 billion in its upcoming US initial public offering (IPO), regulatory filings show. The digital exchange operator and crypto media company plans to price shares between $28 and $31, raising between $568 million and $629 million.

IPO Details and Timeline

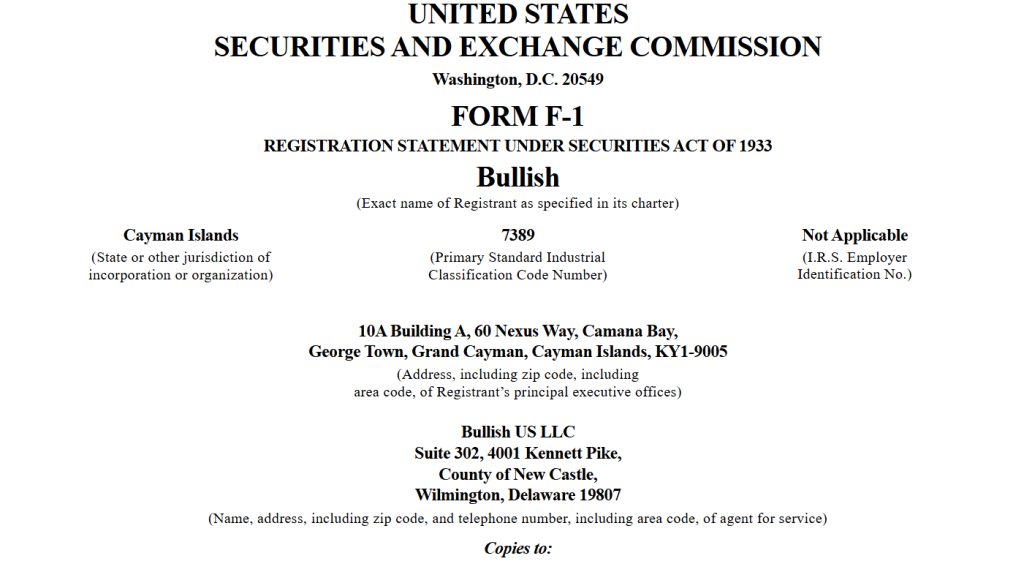

According to an updated F-1 filing with the US Securities and Exchange Commission (SEC), Bullish will issue 20.3 million shares. If approved, trading could begin as early as Aug. 12.

BlackRock and ARK Show Strong Interest

Major institutional players are showing interest. BlackRock and ARK Investment Management have signaled plans to buy up to $200 million worth of stock at the IPO price. Bullish also intends to convert part of the proceeds into US dollar–denominated stablecoins.

Bullish Expands Into Media

The exchange serves institutional clients in over 50 jurisdictions, excluding the US. It entered the media space in November 2023 by acquiring CoinDesk from Digital Currency Group for $72.6 million. CoinDesk averaged 4.9 million unique monthly viewers in 2024, making it the world’s second-largest crypto news outlet.

Crypto IPO Momentum Builds

Bullish joins a growing list of crypto companies heading to public markets. In July, digital asset custodian BitGo filed for a US public offering but did not disclose share numbers or valuation targets.

Meanwhile, Kraken plans to raise $500 million in an IPO valuing the firm at about $15 billion, up from its previous $11 billion valuation. Reports also suggest OKX is preparing for a US IPO after relaunching in the country.

Regulatory Tailwinds Support IPO Growth

Stablecoin issuer Circle staged one of the year’s most successful offerings, increasing its market cap by billions. Before going public, it raised its IPO target to nearly $900 million amid strong demand.

This surge in crypto IPOs comes alongside US regulatory progress and rising institutional adoption of digital assets. Last month, President Donald Trump signed the GENIUS Act — a major stablecoin bill — into law. The House also passed two more bills on market structure and anti-CBDC measures before its August recess.