Bitcoin-XRP ETF Japan: SBI Plans Nation’s First Dual Crypto Fund

Bitcoin-XRP ETF Japan, SBI outlines plans to launch Japan’s first Bitcoin-XRP dual ETF

Bitcoin-XRP ETF Japan, Japanese financial giant SBI Holdings is preparing to launch Japan’s first dual-asset cryptocurrency ETF. This fund will provide exposure to both Bitcoin and XRP.

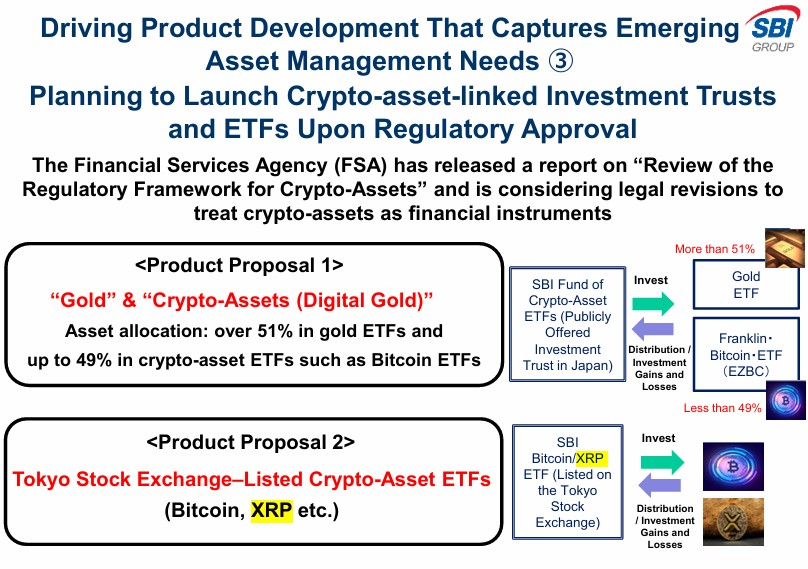

In its latest earnings report, SBI outlined two crypto-based ETF proposals. The first combines gold and crypto assets into a trust. The structure allocates 51% to gold ETFs and 49% to crypto ETFs, including Bitcoin. SBI plans to offer this fund publicly as an investment trust in Japan.

The second product combines Bitcoin and XRP in a single ETF. SBI intends to list this dual crypto ETF on the Tokyo Stock Exchange, Japan’s largest stock market.

🏛️ SBI targets launch after regulatory approval

SBI says it will launch both products after receiving regulatory approval. This statement suggests that discussions with the Financial Services Agency (FSA) are ongoing. If approved, these funds would be the first public crypto ETFs in Japan.

The report also highlights the FSA’s recent efforts to reclassify crypto assets. This move could prepare the ground for these ETFs under new regulatory guidelines.

Some reports claim SBI has already filed the XRP-Bitcoin ETF. However, it’s unclear whether the proposal has reached the FSA or remains in the planning stage. Cointelegraph reached out to SBI and the FSA but received no reply by the time of publication.

📈 Japan’s regulator moves toward crypto reform

On June 24, the FSA proposed classifying certain crypto assets as financial products under the Financial Instruments and Exchange Act (FIEA). This law governs traditional securities in Japan. If passed, the change could open the door to ETFs and reduce crypto taxes for investors.

Currently, Japan classifies crypto as a means of payment under the Payment Services Act. The proposed change would allow some tokens, such as Bitcoin and XRP, to be treated as securities. This shift could transform how crypto investment products like ETFs operate in the country.