Taurus Launches Private Stablecoin Contract with Deutsche Bank and State Street Ties

Crypto Firm for Deutsche, State Street Launches Private Stablecoin Contract

Taurus, a digital asset infrastructure firm, has launched a private stablecoin contract focused on privacy and sensitive business payments.

The contract is built on Aztec Network, combining zero-knowledge proofs with regulatory compliance. Taurus said it could boost adoption for payrolls, intra-company transfers, and other confidential transactions.

The firm already partners with Deutsche Bank and State Street, serving institutional clients looking to integrate blockchain.

Taurus chief security officer JP Aumasson said the contract balances privacy and regulatory access. Issuers and regulators can still verify transactions while users stay anonymous.

Public blockchains, said Arnaud Schenk of Aztec Network, limit adoption due to their transparency. “Our layer-2 provides privacy and issuer-defined controls directly within the token,” Schenk noted.

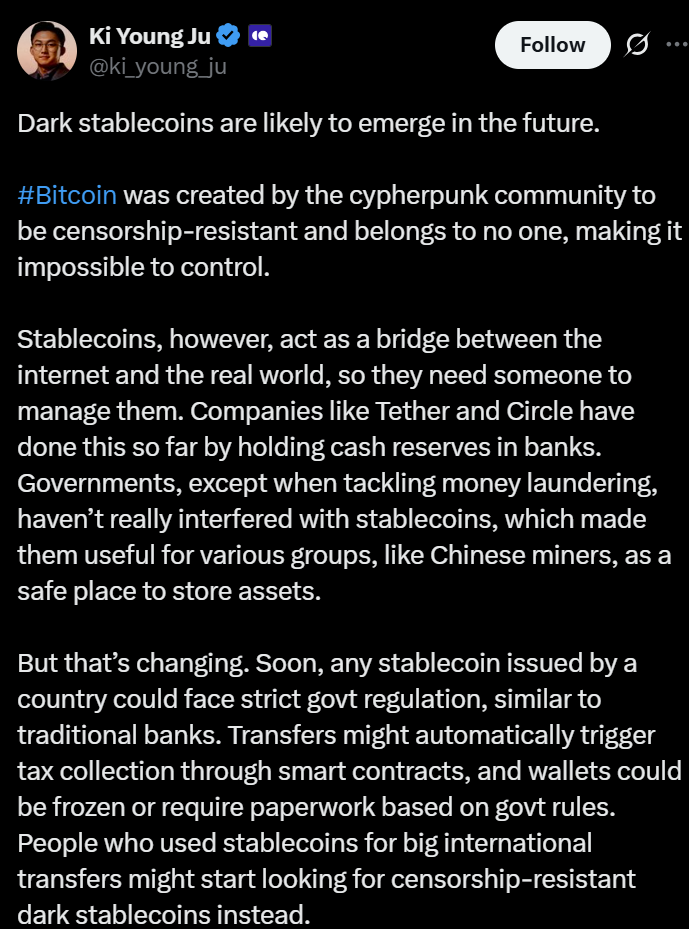

This launch comes amid growing interest in so-called “dark stablecoins”, which are designed to be censorship-resistant.

“Users who need discretion in global transfers may shift to privacy-focused stablecoins,” said CryptoQuant CEO Ki Young Ju. Taurus’ new system offers similar privacy without regulatory risks.

Stablecoin Market Grows, Big Players Eye Entry

The stablecoin market now exceeds $260 billion, acting as a bridge between traditional and decentralized finance.

Tether (USDT) and Circle (USDC) dominate the market, but over 30 issuers hold more than $100 million in circulation, according to RedStone.

Upcoming legislation, including the GENIUS Act in the U.S., may expand the market. The bill recently passed the Senate and could allow tech giants like Meta to issue stablecoins.

In Europe, regulators under the MiCA framework see stablecoins as manageable, even when issued abroad.

Kraken Launches ‘Krak’ App for Global Crypto and Fiat Payments Ahead of 2026 IPO