Household Debt

Introduction

Household debt in Singapore is on the rise, but experts at the Monetary Authority of Singapore (MAS) believe that wage growth and increasing financial assets could provide a buffer. The household debt rise poses concerns for financial stability, but the country’s strong economic fundamentals may mitigate the risks. Let’s explore the dynamics behind this trend and what it means for Singapore’s economy.

1. What’s Driving the Rise in Household Debt?

The increase in household debt can largely be attributed to several factors. For one, the demand for housing in Singapore remains high, especially in the private real estate market. Additionally, more consumers are taking on credit for big-ticket purchases and loans. Over the years, the ease of accessing credit has allowed more households to take on larger financial commitments.

Despite these trends, MAS has highlighted that the overall debt levels are manageable, as long as wage growth and financial assets continue to grow. However, the increase in borrowing must be monitored closely to ensure long-term financial stability.

2. Wage Growth as a Cushion for Debt

One of the main factors that could help offset the impact of rising household debt is wage growth. Singapore has seen steady wage increases in recent years, particularly in sectors like technology, healthcare, and finance. As salaries rise, households are better positioned to service their debts and maintain financial stability.

MAS has emphasized that a continued increase in wages will provide a safety net for many Singaporeans. With higher incomes, households are likely to have more disposable income, which can be used to pay down debt or invest in financial assets. This, in turn, reduces the risk of defaults and financial strain.

3. The Role of Financial Assets in Reducing Debt Burden

Another important factor in managing household debt is the growth in financial assets. Over the years, Singaporeans have built up significant wealth in savings, stocks, bonds, and retirement accounts. The increasing value of these assets can provide a cushion, as households are able to leverage them to reduce debt or enhance their financial security.

For example, many Singaporeans contribute to the Central Provident Fund (CPF), which serves as a long-term savings vehicle. The growth of CPF balances over time can give individuals more financial flexibility to manage debts, especially in retirement. Additionally, the increase in property values has bolstered household net worth, making it easier to handle liabilities.

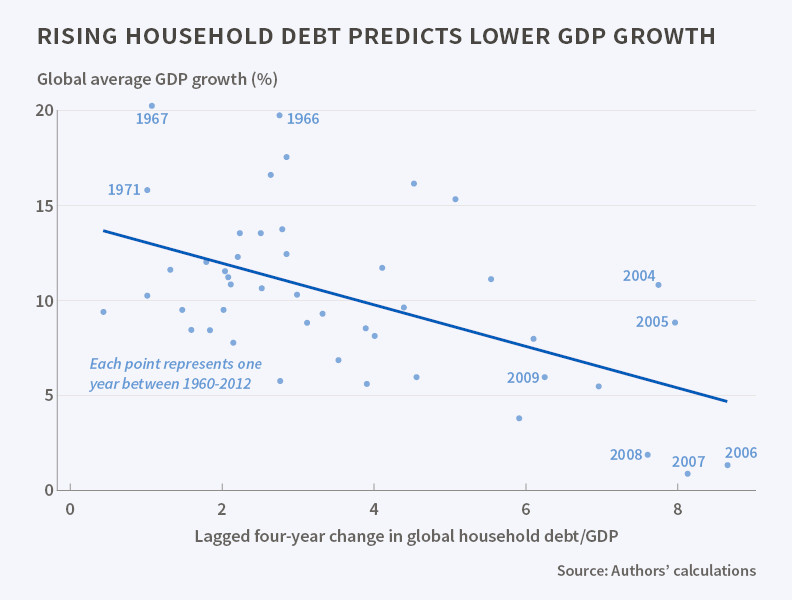

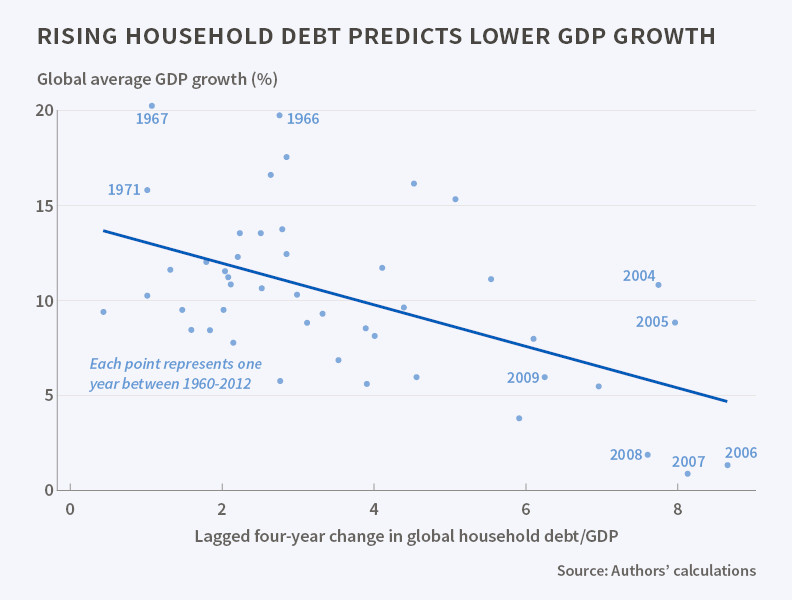

4. Managing Risks to Financial Stability

Despite the growth in financial assets, MAS is cautious about the potential risks associated with rising household debt. If the pace of debt accumulation outstrips wage growth and asset growth, households may find it harder to manage their financial commitments. This could lead to higher default rates and strain on the banking system.

MAS has called for greater vigilance in monitoring borrowing patterns, especially in the housing market, where over-leveraging is a concern. The government has implemented measures, such as loan-to-value (LTV) limits and debt servicing ratios, to prevent excessive borrowing. These regulations help ensure that households can handle their debt without overextending themselves.

5. The Outlook for Household Debt in Singapore

Looking forward, the outlook for household debt in Singapore remains cautiously optimistic. While debt levels are expected to continue rising, MAS believes that the combination of wage growth and increasing financial assets will help buffer households from potential financial stress.

However, external factors such as interest rate changes, economic downturns, or changes in the housing market could impact the debt servicing capacity of households. It’s crucial for both policymakers and individuals to remain mindful of these risks and take steps to ensure long-term financial stability.

Conclusion

The rise in household debt in Singapore is a developing trend, but it may be cushioned by wage increases and the growth of financial assets. While there are risks involved, the strong economic foundation and prudent financial management in Singapore should help mitigate these challenges. With careful monitoring and strategic policies, Singapore can manage rising debt levels without compromising long-term financial stability.