Animoca Brands Taps DDC Enterprise to Deploy $100M BTC Treasury

Animoca Brands Partners With DDC Enterprise to Activate BTC Treasury Strategy

Animoca Brands, a leading Web3 company, has entered a strategic partnership with DayDayCook (DDC) Enterprise to deploy its Bitcoin holdings and earn yield on them — joining a growing cohort of companies leveraging BTC as a corporate treasury asset.

The companies signed a non-binding memorandum of understanding (MOU) on Thursday. As part of the deal, Animoca will allocate up to $100 million worth of Bitcoin, aiming to optimize returns on idle reserves while reinforcing its long-term conviction in the asset.

Animoca Brands: Strategic Alignment With DDC’s Vision

Speaking to Cointelegraph, Animoca co-founder and executive chairman Yat Siu highlighted DDC CEO Norma Chu’s global appeal and her capacity to introduce Bitcoin to non-crypto-native audiences:

“Her background and her experience enable Norma to bridge the East and West to successfully navigate markets on both sides of the planet; she has good appeal and connections to the Chinese market, one of the largest for crypto adoption, while also running a NASDAQ-listed company.”

DDC entered the Bitcoin treasury space in May, setting an ambitious target to acquire 5,000 BTC over the next three years. It began with a 21 BTC purchase, signaling its commitment to diversifying corporate reserves with a supply-capped digital asset.

Bitcoin Treasury Momentum Accelerates in 2025

Animoca’s partnership reflects a larger trend: the surging popularity of Bitcoin as a treasury reserve strategy. Companies are increasingly turning to BTC as a hedge against inflation, economic instability, and fiat depreciation. For some, Bitcoin holdings now form the core of their corporate identity.

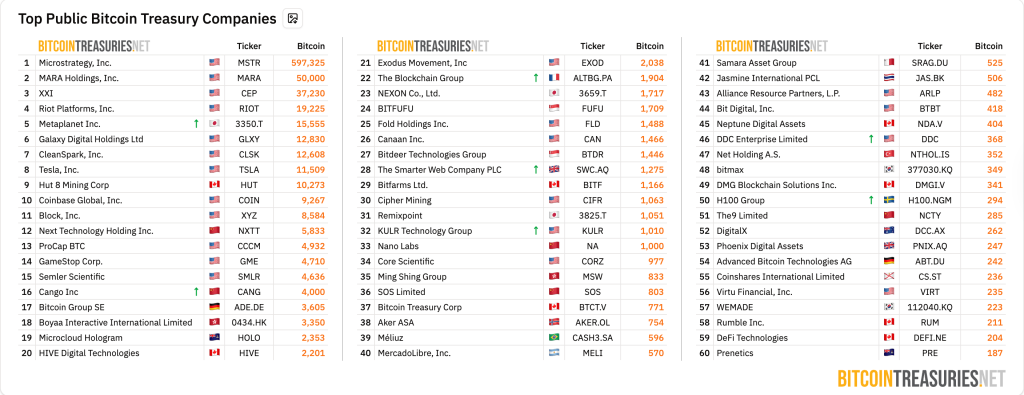

According to BitcoinTreasuries, 268 institutions currently hold Bitcoin on their balance sheets. This group includes public and private companies, crypto firms, asset managers, and even government entities. Among them, public companies dominate, accounting for 147 of the 268 holders.

In Q2 2025 alone, treasury-focused firms accumulated 159,107 BTC — a stash valued at $18.7 billion at current prices. That marks a 23% increase from the previous quarter.

Not Without Risks

Although Bitcoin’s growing adoption in corporate finance has excited many investors, some analysts have raised concerns. They argue that overleveraged companies with weak fundamentals could become ticking time bombs if BTC prices correct sharply.

In June, Blockstream CEO Adam Back likened the Bitcoin treasury trend to a new altseason for crypto traders:

“Time to dump ALTs into BTC or BTC treasuries,” he wrote in a June 22 X post.

Nonetheless, skeptics warn that many of these firms won’t survive the next bear market. As financing conditions tighten, BTC price volatility may force short-term treasury players to liquidate holdings, potentially triggering broader market stress.