Inflation has surged once more, creating economic ripples as the world enters the “final mile” before the New Year. For many, this latest spike in prices underscores the mounting financial pressures facing households and businesses alike.

Economic analysts report that key drivers

of inflation include rising energy costs, persistent supply chain issues, and increased consumer demand during the holiday season. As prices climb, essential goods such as groceries and fuel are becoming harder to afford, straining family budgets.

Central banks have responded with tighter monetary policies to curb inflation. Interest rate hikes, a primary tool to slow down inflation, are being closely monitored. However, these measures come with their own challenges, including the potential for slowed economic growth.

The impact of inflation is particularly evident during the holiday shopping season. Retailers are grappling with higher operating costs, which are often passed on to consumers. Meanwhile, workers are finding that their wages, even if increased, are failing to keep pace with rising living expenses.

Experts warn that inflation’s persistent

rise could dampen consumer confidence heading into 2024. “The economy is walking a tightrope,” one financial strategist explained, highlighting the delicate balance between controlling inflation and avoiding a recession.

With just days left in the year, many are watching for signs of relief. Policymakers and economists agree that combating inflation will remain a top priority in the coming months. As households adjust to the new economic reality, financial resilience and budgeting will be crucial to weathering the storm.

In this final stretch of the year, inflation serves as a stark reminder of the ongoing economic challenges and the need for strategic solutions as we move into the New Year.

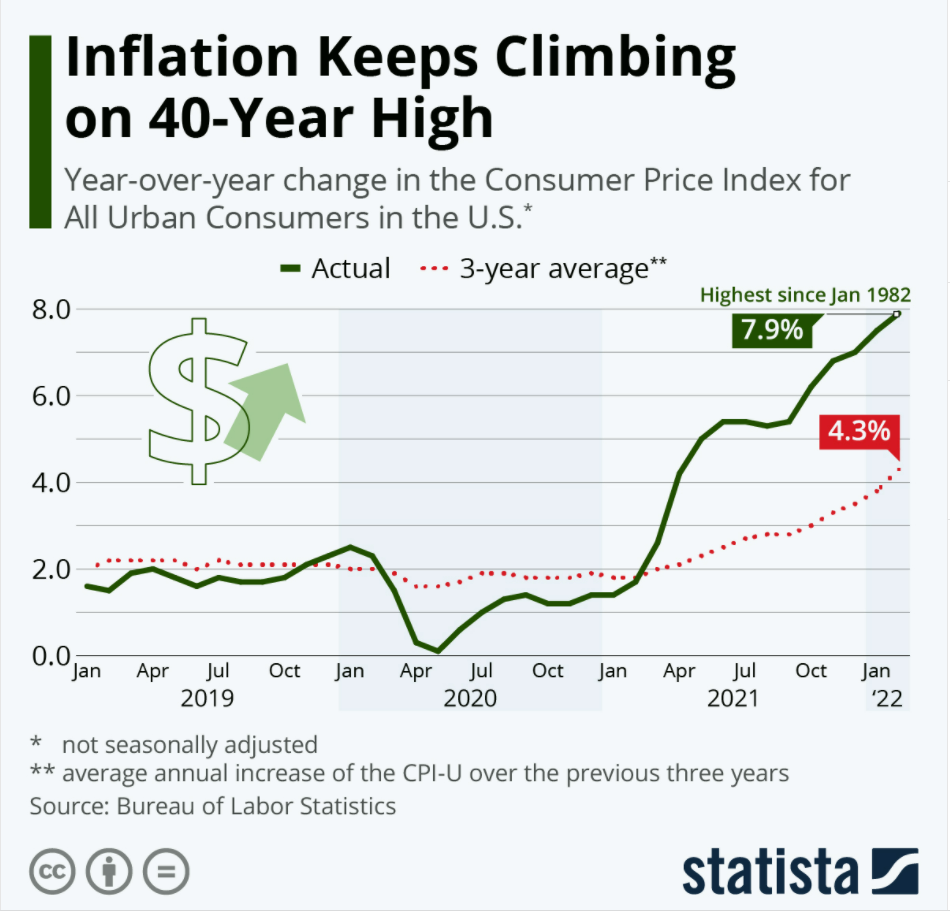

By likening efforts to reduce the rate of inflation to a long-distance race, many economists call 2024 "the final mile" or the last mile before the finish line. But inflation has not yet reached the 2 percent target, and even jumped again towards the turn of the year.