Donald Trump Urges Quick House Vote on GENIUS Stablecoin Bill

Trump on GENIUS Stablecoin Bill: ‘Get It to My Desk, ASAP’

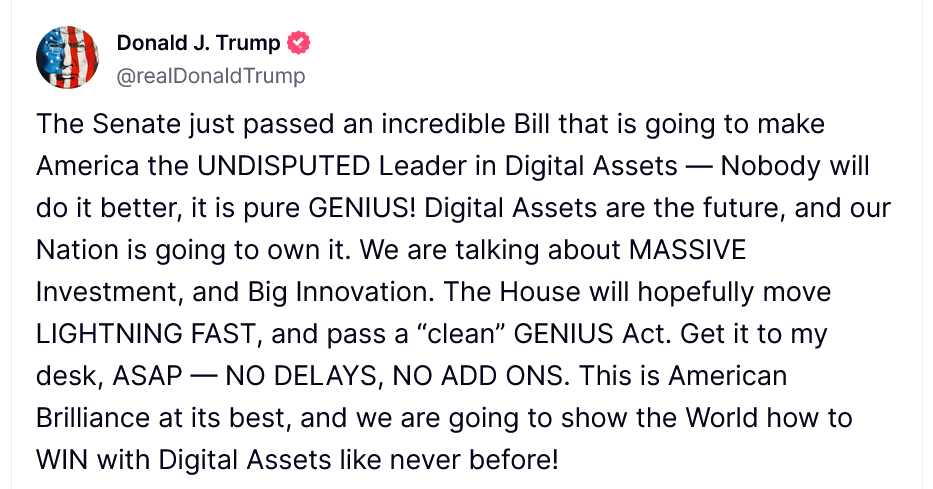

U.S. President Donald Trump is urging lawmakers to fast-track the GENIUS Act, a bill that sets national standards for stablecoins. He called for its approval in the House “LIGHTNING FAST,” following the Senate’s recent passage.

“The Senate just passed an incredible Bill that is going to make America the UNDISPUTED Leader in Digital Assets,” Trump posted on Truth Social.

“Get it to my desk, ASAP — NO DELAYS, NO ADD ONS.”

The Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act) passed the Senate on Tuesday with a 68–30 vote. The bill now heads to the House, where Republicans hold a narrow majority.

GENIUS Act Aims to Boost U.S. Digital Leadership

Supporters argue the GENIUS Act will strengthen the U.S. dollar’s role in the digital economy. Many believe it gives the U.S. a clear lead in blockchain-based payments.

According to bill sponsor Senator Bill Hagerty, the bill will benefit both businesses and consumers. It would allow instant payment settlement, eliminating long delays common with traditional banking systems.

Democratic Pushback Delayed Passage

The GENIUS Act initially failed a Senate cloture vote in May. At the time, several Democrats raised concerns about Trump’s ties to crypto firms.

Senator Elizabeth Warren was among the most vocal critics. She warned that Trump and his family stood to gain “hundreds of millions” from a stablecoin called USD1 if the bill were signed into law.

Even so, others in her party acknowledged the urgency. Senator Mark Warner said, “We can’t afford to keep standing on the sidelines” while global crypto innovation moves ahead.

Bill Sets Ground Rules for Stablecoin Issuers

If passed, the GENIUS Act would establish strict regulations for U.S. dollar–pegged stablecoins. Key provisions include:

- Full 1:1 reserve backing

- Licensing at the state or federal level

- Strict AML (Anti-Money Laundering) checks

- Clear consumer protections

Furthermore, stablecoin issuers would be barred from using reserves for anything except redemption or safe investments like Treasury repos. This aims to prevent the rise of shadow banking risks in the crypto space.