Parataxis Acquires Korean Biotech Firm to Launch Bitcoin Treasury Platform

Parataxis Acquires Korean Biotech Firm to Launch Bitcoin Treasury Platform

Parataxis Holdings, an affiliate of digital asset investment firm Parataxis Capital Management, is launching a Bitcoin-native treasury platform in the South Korean public market.

The company announced on Friday that it had signed a definitive agreement to invest 25 billion Korean won ($18.5 million) in Bridge Biotherapeutics, a publicly listed biotech firm.

Following the acquisition, Parataxis will take majority control and rebrand the company as Parataxis Korea, transforming it into a Bitcoin-focused treasury vehicle designed for institutional exposure.

“Inspired by the growing interest in BTC treasury strategies seen in companies like Strategy in the U.S. and Metaplanet in Japan, we believe institutional interest is rising globally,” said Andrew Kim, Partner at Parataxis Capital. “We see South Korea as a key market in the global expansion of BTC adoption.”

Kim emphasized that the company aims to facilitate institutional access to Bitcoin while maintaining strong corporate governance and disciplined capital management.

South Korea Still Restricts Institutional Crypto Access

Although South Korea currently bans crypto ETFs and institutional digital asset investments, the country’s Financial Services Commission (FSC) has allowed 3,500 companies and professional investors to open “real-name” crypto accounts as part of a pilot program in the first half of 2025.

This initiative is intended to gradually introduce regulated access for institutional digital asset trading.

Parataxis’ treasury launch comes shortly after the New York-based firm announced plans to go public via a $200 million special purpose acquisition company (SPAC), as reported by Cointelegraph on June 10.

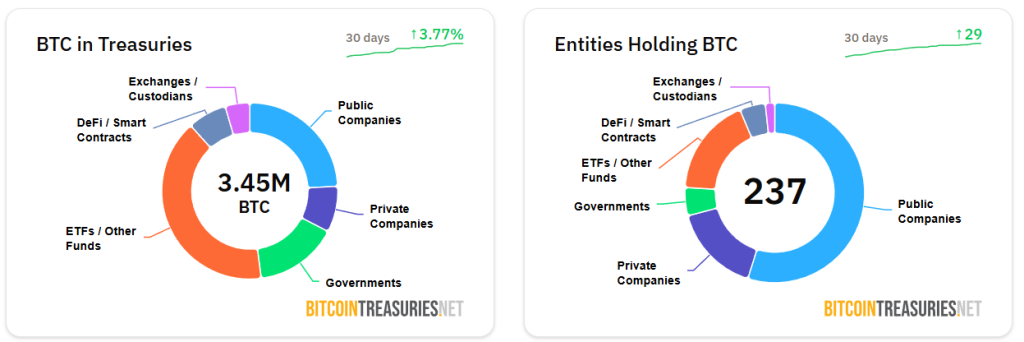

The move is part of a broader trend of corporate Bitcoin adoption. According to BitcoinTreasuries.NET, more than 237 public companies now hold BTC on their balance sheets—nearly doubling from just weeks earlier—accounting for roughly 3.96% of Bitcoin’s total circulating supply.

Stock Surge Follows Acquisition News

Bridge Biotherapeutics’ stock surged over 20% following news of the Parataxis acquisition, based on TradingView data. However, the stock remains down 74% year-to-date and over 90% from its five-year peak.

Founded in 2015 and listed on Korea’s KOSDAQ in 2019, Bridge Biotherapeutics focuses on treatments for ulcerative colitis, fibrotic diseases, and cancer.

Also on Friday, London-based AI firm Pri0r1ty Intelligence Group said it would adopt Bitcoin as a reserve asset and payment method—though it did not confirm a direct BTC purchase. Following the announcement, the firm’s stock jumped 84%, reversing a one-year downtrend of 32%, according to Google Finance data.

Not all companies have seen positive reactions. GameStop shares plunged more than 22% after the company increased its convertible note offering to $2.25 billion, which some analysts interpreted as a sign of potential deeper involvement in crypto.