Spot Ether ETFs Surge: $533M Daily Inflows Extend 13-Day

Spot Ether ETFs Attract $533M, Extending 13-Day Inflow Streak to Over $4B

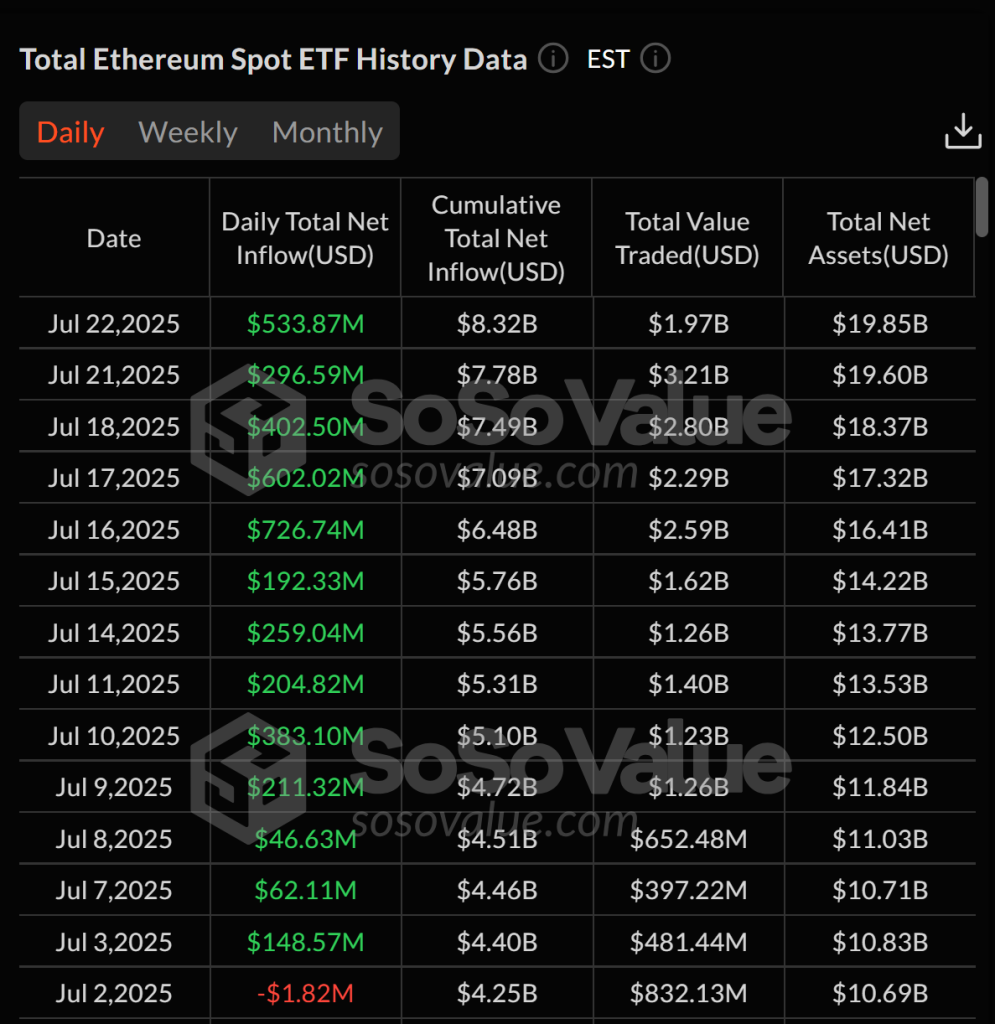

Spot Ether ETFs pulled in $533.87 million in net inflows on Tuesday, marking 13 consecutive trading days of positive momentum, according to data from SoSoValue. The streak reflects rising institutional demand and growing investor confidence in Ethereum.

BlackRock’s iShares Ethereum Trust (ETHA) led the daily inflow tally with $426.22 million, boosting its total assets under management (AUM) to over $10 billion, the highest in the Ether ETF market. Fidelity’s FETH followed with $35 million in new capital.

“Spot Ether ETF inflows have been driven by falling Bitcoin dominance and rising institutional appetite for ETH exposure. With growing liquidity and stable macro conditions, this demand is likely to continue,” said Vincent Liu, CIO of Kronos Research.

Total net inflows across all Ether ETFs have now reached $8.32 billion, up from $4.25 billion at the start of the streak on July 2. The total value of Ether held in these funds has climbed to $19.85 billion, representing 4.44% of Ethereum’s market cap.

Spot Ether ETFs Pull in Over $4 Billion Since Early July

Since July 3, spot Ether ETFs have accumulated more than $4 billion in inflows. Notably, July 16 saw a record $726.74 million added in a single day, the highest since the ETFs launched. Thursday’s inflows came close, totaling $602.02 million.

“Ethereum ETPs are significantly underweight compared to Bitcoin. ETH’s market cap is about 19% that of BTC, yet Ethereum ETPs only hold 12% of the assets of Bitcoin ETPs,” said Matt Hougan, CIO at Bitwise.

Hougan also forecasted rising ETH demand from public companies and institutional vehicles, projecting that up to $20 billion could flow into ETH-related products over the next year—equivalent to 5.33 million ETH.

By contrast, Ethereum is projected to issue just 0.8 million ETH over the same period, implying that demand may exceed supply by nearly 7x, potentially driving prices higher.

On-chain data from Lookonchain further supports the accumulation trend, noting that five newly created wallets withdrew 76,987 ETH (worth $285 million) from Kraken on Wednesday, shrinking exchange supply.

Spot Bitcoin ETFs See Outflows Amid Ether Surge

While Ether ETFs gained traction, spot Bitcoin ETFs posted a net outflow of $67.93 million on Tuesday. The largest outflows were from Bitwise’s BITB ($42.27M) and ARK’s ARKB ($33.18M). In contrast, Grayscale’s GBTC was the only ETF with a positive balance, recording a modest $7.51 million in inflows.

These outflows follow major inflow days earlier in July, including $1.18 billion on July 10 and $1.03 billion on July 11—indicating short-term repositioning among institutional investors.